Global Market Daily Report – Visa Inc. (V)

Date:

1. Market Events (Global Market Events Today)

The global market remained stable today without major catalysts. Among individual names, Visa (V) stood out—not for explosive growth, but for its long-term defensive characteristics that make it worth highlighting.

2. Watchlist & Notable Stocks

Visa Inc. (V)

Sector: Electronic Payments · Fintech Infrastructure · NYSE

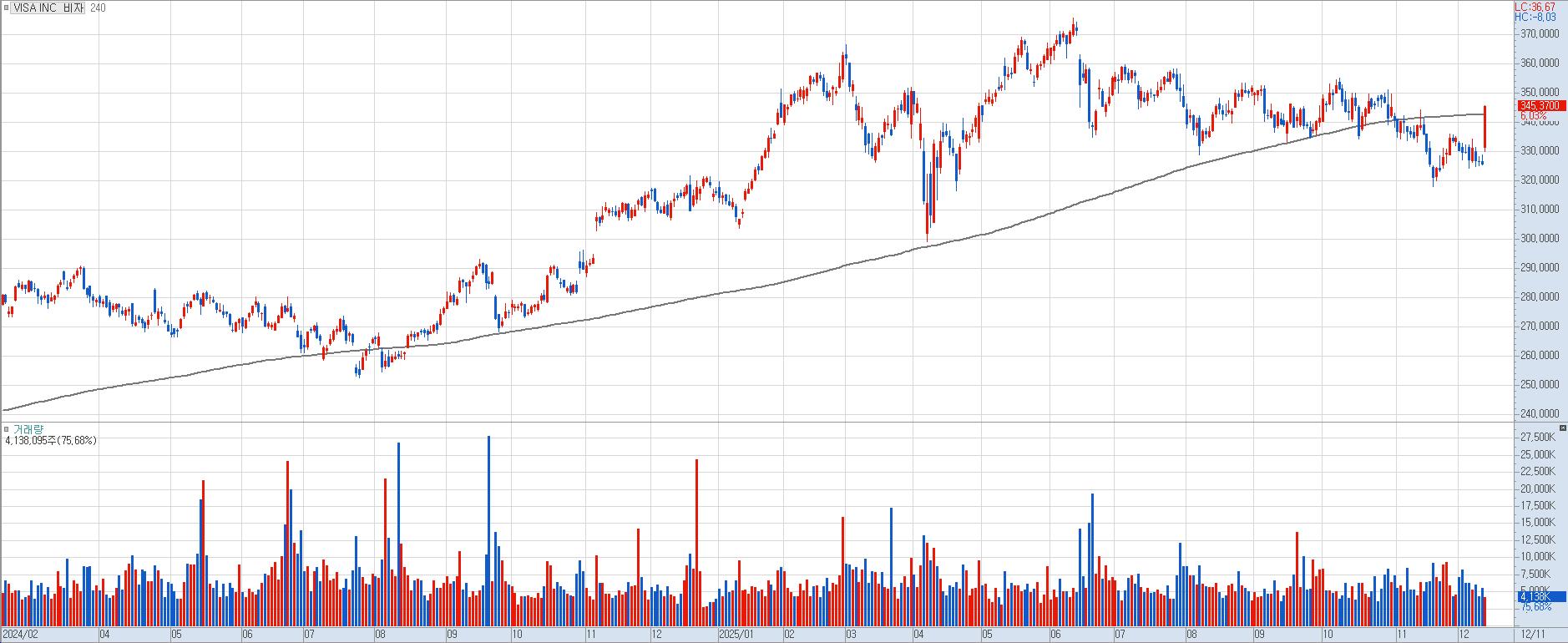

Chart Commentary

Today’s featured company is somewhat tricky to classify as a pure “growth stock.” While Visa continues to expand globally and maintain strong profitability, its behavior resembles that of a long-term defensive compounder.

It’s the type of stock that makes you think: “Is this better than leaving cash in a savings account?” The answer often leans toward yes, given Visa’s consistent track record.

However, for anyone considering leverage, a word of caution: based on experience, Visa is not suitable for leveraged trades. The volatility profile does not reward amplified exposure, and pullbacks can be abrupt and unforgiving.

For long-term investors, Visa offers stability. For leveraged traders, it offers unnecessary risk.

3. Fundamentals & Earnings Outlook

Visa continues to deliver steady revenue growth and reliable profitability. EPS and net income remain on an upward trajectory, reflecting the company’s dominant positioning in global payments. Nothing overly hyper-growth — but highly dependable.

4. Company Overview

Visa operates one of the world’s largest electronic payment networks, connecting financial institutions, merchants, consumers, and governments through its VisaNet infrastructure.

The company provides global payment processing, settlement systems, merchant gateway services, and digital payment solutions such as Visa Checkout, Visa Direct, and Visa Token services.

Visa’s brands—including Visa, Electron, Interlink, VPAY, and PLUS—are used across more than 200 countries, supporting over 3 billion cardholders worldwide. Its scale and reliability make Visa a cornerstone of global financial infrastructure.

5. Trader Notes

Visa is not a fast-moving growth rocket, but a stable long-term performer. It tends to track inflation and macroeconomic expansion rather than delivering dramatic spikes.

For long-term compounding, Visa makes sense. For traders attempting to use leverage, however, it is far from ideal. This stock rewards patience, not forced exposure.