Global Market Daily {{ 2025-12-09 }}

Monitored Markets: Nasdaq, S&P 500, Japan (Nikkei), China, Germany (DAX), UK (FTSE 100), Korea (KOSPI), Gold, Crude Oil, Dollar Index (DXY), Bitcoin, Ethereum

1. Market Events (Global Market Events Today)

No major macro catalysts hit the market today.

Indices traded relatively calm, but single-stock volatility was notable, especially in biotech.

Kymera Therapeutics (KYMR) printed one of the loudest signals with explosive volume and a sharp upside move.

2. Watchlist & Notable Stocks

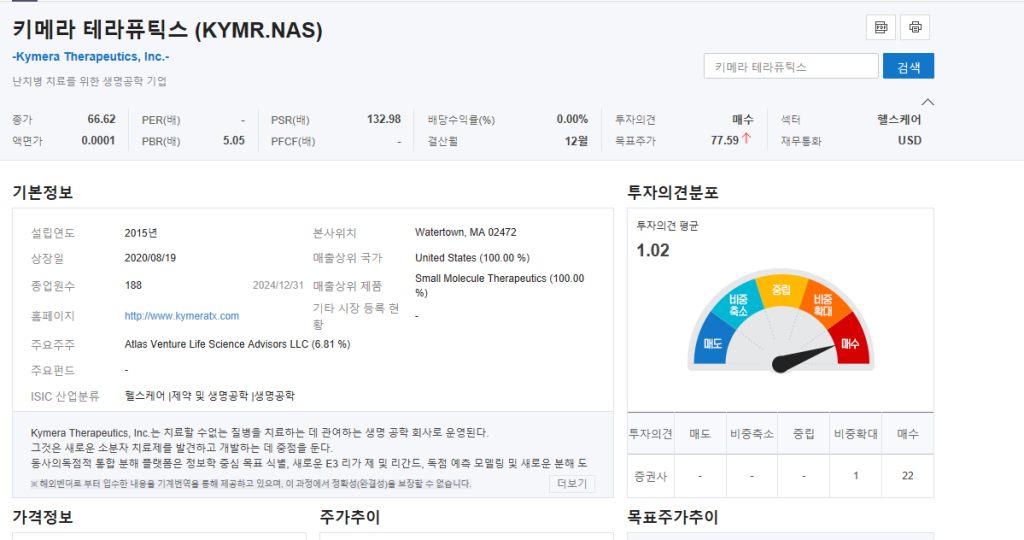

Kymera Therapeutics (KYMR)

Fundamentals & Earnings Outlook

Kymera is still fundamentally in the red.

Revenue is projected to grow, but the company remains early-stage with negative EBITDA and ongoing R&D burn.

The market, however, has clearly begun pricing in future optionality rather than current performance.

Company Snapshot

Today’s candle was dramatic:

- Volume exploded to multi-month highs

- Price surged aggressively, breaking through resistance

- Mid-term trend remains structurally bullish

At first glance, the setup looks tempting.

Many traders would think, “With this kind of volume and momentum, maybe I should swing the bat here.”

But my answer is still no — I’m not buying it.

Even though I acknowledge the long-term probability of continued upside is high,

I don’t swing at 70-point pitches.

I only swing at 90s and 100s — the pitches that I truly know how to hit.

3. Market Summary & Trader Notes

From a trader’s perspective, KYMR checks several boxes:

- Volume ✔

- Momentum ✔

- Trend ✔

- Sentiment rotation into biotech ✔

It looks attractive enough that many would take a shot.

But here’s my stance:

I don’t smoke, but I’ve always liked this analogy:

A stock can look like Warren Buffett’s “cigar-butt” — a final puff worth taking…

but only if it’s the right cigar.

KYMR is not that cigar for me today.

I’m not interested in swinging my bat at a pitch that’s only good enough.

Good trades are plentiful — great trades are rare, and those are the ones I wait for.

So yes, KYMR may keep rising.

But today, the correct move for me was to pass.